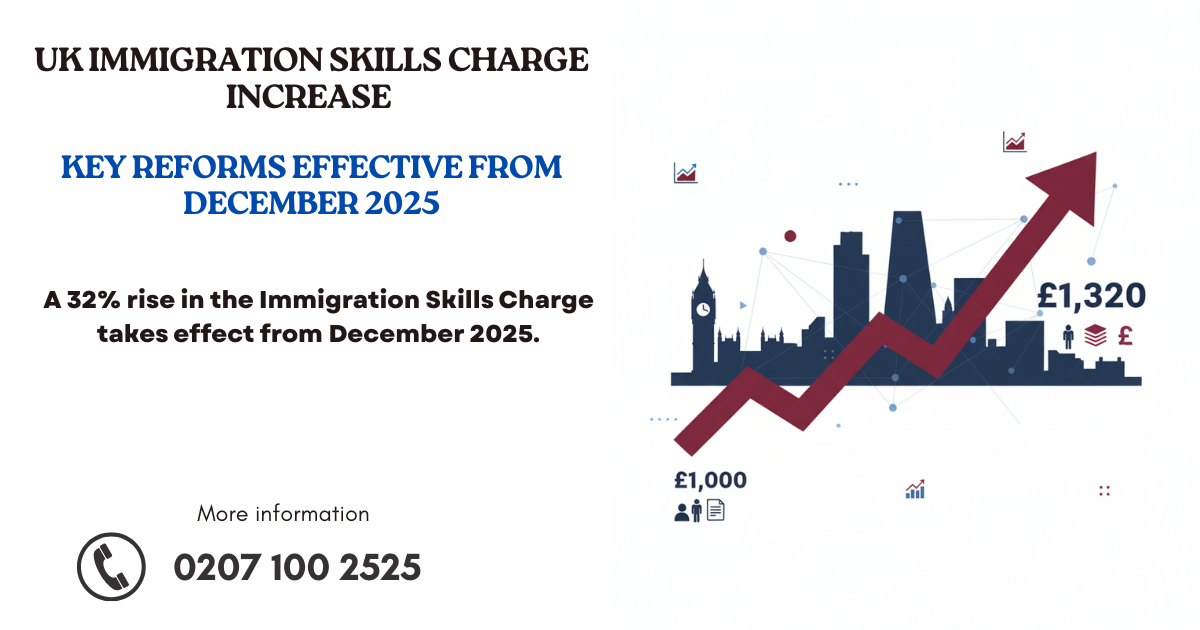

The Immigration Skills Charge (ISC) will rise on December 16, 2025, according to confirmation from the Home Office. Employers in the UK who sponsor foreign workers under the Skilled Worker and associated sponsored work pathways would be directly impacted by this move.

Early preparation and strategic counsel are more crucial than ever for businesses that depend on foreign talent because the increase reflects a large increase in sponsorship expenses.

What is the Immigration Skills Charge?

Employers in the UK are required to pay the Immigration Skills Charge when they sponsor certain migrant workers. It is determined by the duration of sponsorship and paid at the time a Certificate of Sponsorship (CoS) is issued.

The fee is intended to incentivise employers to make investments in domestic workers. Crucially, the sponsor is responsible for covering the expense and cannot transfer it to the sponsored employee.

What is Changing?

All sponsor categories will see an increase in the ISC starting on December 16, 2025.

New Immigration Skills Charge Rates

Large and medium-sized sponsors

- £1,320 annually for sponsorship

- £660 for every extra six months

Small sponsors and charitable organisations

- £480 annually for sponsorship

- £240 for every extra six months

When Will the New Rates Apply?

The increased charge will apply to Certificates of Sponsorship assigned on or after 16 December 2025.

This means:

- Certificates assigned before this date will remain subject to the current lower rates, even if the visa application is submitted later.

- Certificates assigned on or after this date will attract the higher charge.

Timing will therefore be critical for employers with upcoming recruitment plans.

What Should Employers Do Now?

- Examine plans for sponsorship

If allowed, employers who plan to sponsor foreign workers in late 2025 or early 2026 should determine whether Certificates of Sponsorship can be issued prior to the increase’s implementation.

- Set aside money for increased expenses

The total cost of sponsorship will rise dramatically as a result of the higher ISC, especially for long-term positions. Companies should make sure the increased costs are reflected in their hiring budgets.

- Maintain compliance

Employers are required to continue fulfilling all sponsor licensing requirements, including as paying the appropriate fees and making sure sponsored workers are not unjustly charged for expenses.

How We Can Help

At Adam Bernard Solicitors, we provide clear, practical legal advice to UK employers navigating the evolving immigration landscape. Our experienced business immigration team can assist with:

- Strategic planning to manage increased Immigration Skills Charge costs

- Advice on Certificate of Sponsorship timing ahead of regulatory changes

- Sponsor licence applications, renewals, and ongoing compliance support

- Skilled Worker visa and business immigration applications

- Risk management to ensure full compliance with Home Office immigration rules

If your organisation sponsors overseas workers or is planning to do so, we can help you prepare for the December 2025 changes with confidence.

Frequently Asked Questions

What is the Immigration Skills Charge (ISC)?

The Immigration Skills Charge is a mandatory fee that UK employers must pay when sponsoring certain overseas workers under sponsored work routes, including the Skilled Worker route. The charge is payable when assigning a Certificate of Sponsorship (CoS).

Why does the Immigration Skills Charge exist?

The ISC is intended to encourage UK employers to invest in training and upskilling the domestic workforce while continuing to allow access to overseas talent where needed.

When will the Immigration Skills Charge increase?

The increased Immigration Skills Charge will apply from 16 December 2025.

Which sponsors will be affected by the increase?

All sponsors assigning Certificates of Sponsorship under routes where the ISC applies will be affected, including:

- Medium and large sponsors

- Small sponsors

Charitable organisations

What are the new Immigration Skills Charge rates?

From 16 December 2025:

- Medium and large sponsors:

£1,320 per year of sponsorship

£660 for each additional six-month period - Small sponsors and charitable organisations:

£480 per year of sponsorship

£240 for each additional six-month period

When do the new rates apply?

The new rates apply to Certificates of Sponsorship assigned on or after 16 December 2025.

Will the higher charge apply if the visa application is submitted after 16 December 2025?

No. What matters is the date the Certificate of Sponsorship is assigned, not the date the visa application is submitted.

Will Certificates of Sponsorship assigned before 16 December 2025 be affected?

No. Certificates assigned before 16 December 2025 will remain subject to the current lower Immigration Skills Charge rates.

Can the Immigration Skills Charge be passed on to the sponsored worker?

No. The ISC must be paid by the sponsoring employer and cannot lawfully be recovered from the sponsored worker, either directly or indirectly.

Does the Immigration Skills Charge apply to all visa routes?

No. The ISC applies only to specific sponsored work routes, such as the Skilled Worker route. Some categories and circumstances may be exempt.

Are there any exemptions from paying the Immigration Skills Charge?

Certain exemptions may apply, including:

- Some PhD-level roles

- Workers switching from certain student routes

- Specific visa categories

Professional advice should be sought to confirm whether an exemption applies in any individual case.

How is the Immigration Skills Charge calculated?

The charge is calculated based on the total length of sponsorship stated on the Certificate of Sponsorship, including part-year periods charged in six-month increments.

How will the increase affect long-term sponsorship?

For roles sponsored for multiple years, the increase will significantly raise overall sponsorship costs. Employers should factor this into long-term workforce and budgeting plans.

How can legal advisers help with the Immigration Skills Charge increase?

Immigration advisers can assist with:

- Strategic timing of Certificates of Sponsorship

- Cost planning and budgeting

- Sponsor licence compliance

- Skilled Worker visa applications

- Risk management to avoid Home Office penalties